deferred sales trust example

Olden Lane Securities LLC and Olden Lane Trust Author. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

A Tax Deferral Strategy Useful for Converting High Value Assets to Active Real Estate and Other Investment Types.

. What is a Deferred Sales Trust. Here is another example of a couple in California selling a highly. Today we bring you Part 2 of our series covering the Deferred Sales Trust DST.

Securities and Exchange Commission Subject. Save Time and Money by Creating and Downloading Any Legally Binding Agreement in Minutes. DST is an example of an unusual sale.

You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. Deferred Sales Trust the assets of which can be managed to each taxpayers own individual risk tolerance and preferences. Ad Create a Living Trust to Seamlessly Transfer Your Property or Assets to a Beneficiary.

Ad A Checklist for Trust Funds Organizing Your Financial Documents. With an IRA you defer paying taxes on. Request Our Free Estate Planning Documents free Financial Information You Need.

All Major Categories Covered. Primary Benefi ts of the Deferred Sales TrustTM Estate Tax. Typically when appreciated property is sold the gain is.

AND INDEX LINKED ANNUITY CONTRACT. Box 1547 Secaucus New. Deferred Sales Trust or DST.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. The DST is a legal tax.

Rather than a typical transaction where the seller would receive funds. FLEXIBLE PREMIUM DEFERRED VARIABLE. Think of a Deferred Sales Trust DST as an IRA for real estate and business sales with additional flexibility.

Maximum deferred sales charge load None Maximum sales charge load imposed on reinvested dividends None Redemption or exchange fees None. AXA Equitable Life Insurance Company PO. Select Popular Legal Forms Packages of Any Category.

Order Under Section 6c of the Investment Company Act of 1940. You and your include Deutsche Bank National Trust Company and any and all persons acting for or in concert with Deutsche Bank National Trust Company. By Greg Reese Certified Trustee for the Deferred Sales Trust.

Deferred Sales Trust Case Studies. There are other types of tax-favorable exchanges you may know. Steve employs a deferred sales trust to sell his 19 million propertyJoin Our No-Cost Deferred Sales.

Today Ill discuss a deferred sales trust scenario.

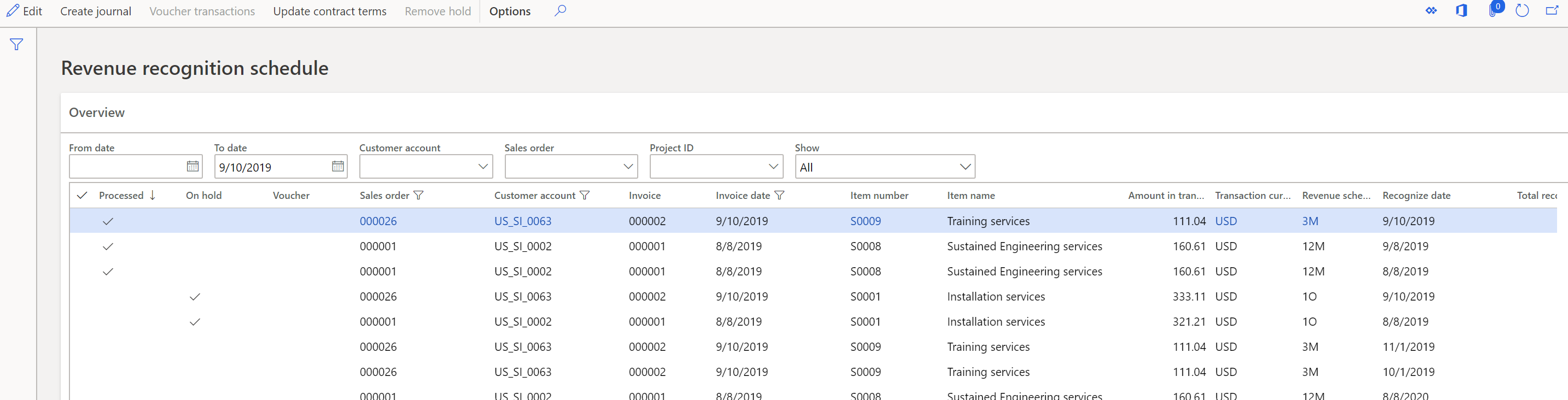

Recognize Deferred Revenue Finance Dynamics 365 Microsoft Docs

Deferred Sales Trust Defer Capital Gains Tax

Definition Of A Grantor Settlor Or Trustor Of A Trust Ameriestate

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

![]()

Deferred Sales Trust Atlas 1031

Deferred Sales Trust Defer Capital Gains Tax

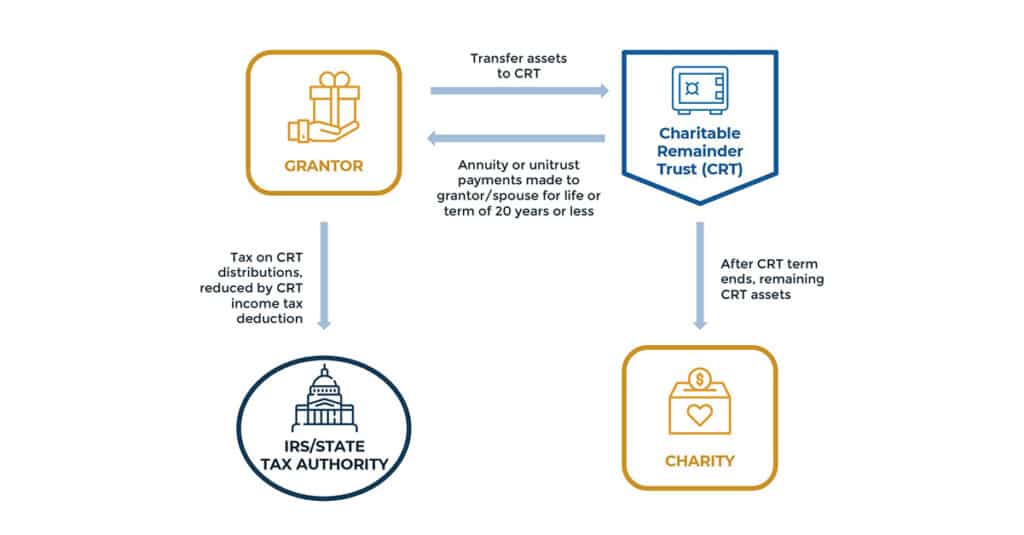

Charitable Remainder Trusts Crts Wealthspire

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

![]()

Deferred Sales Trust Atlas 1031

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Installment Sale To An Idgt To Reduce Estate Taxes

![]()

Deferred Sales Trust Atlas 1031

Deferred Sales Trust Defer Capital Gains Tax

Capital Gains Tax Deferral Capital Gains Tax Exemptions